Impressive Tips About How To Apply For Homeowners Exemption

Each county has different applications and required documents.

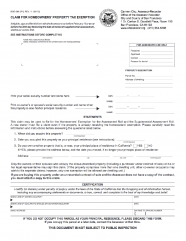

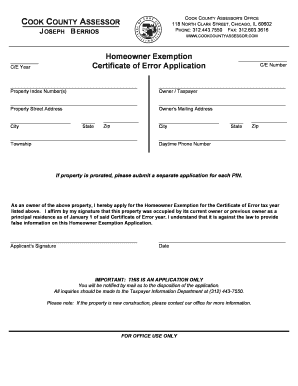

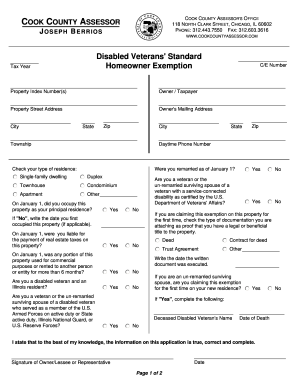

How to apply for homeowners exemption. You may call the assessor's office at the number below for more specific information. Age 65 or older and disabled exemptions:. The home must have been the principal place of residence of the owner on the lien date, january 1st.

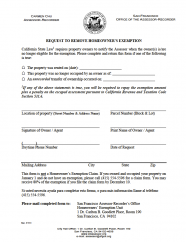

Please see additional details below on the role. *you must provide your social. Exemption forms may be filed online, or you can obtain one by calling one of the.

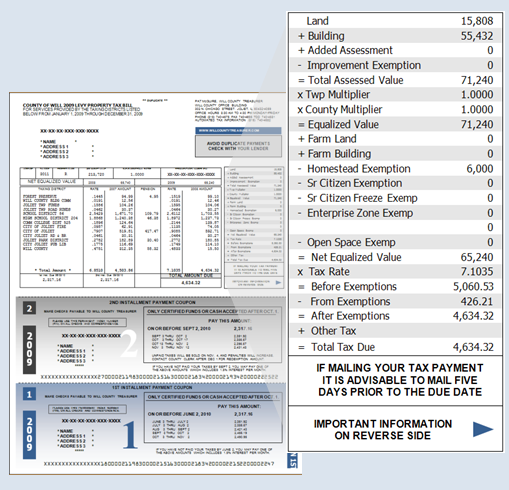

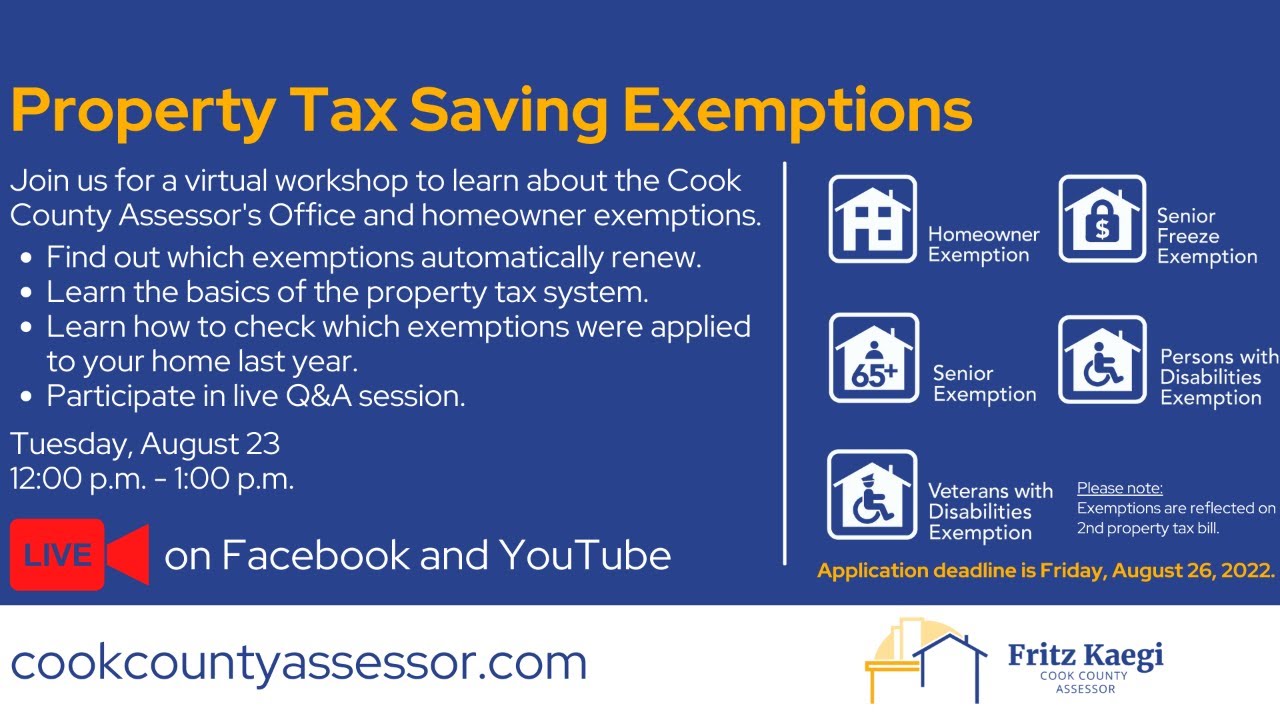

Property tax exemptions are provided for owners with the following situations:homeowner exemptionsenior citizen exemptionsenior freeze exemptionlongtime homeowner. You must complete an application for a homestead exemption. If you own a home and it is your principal place of residence on january 1, you may apply for an exemption of $7,000 from your assessed value.

Certification (all owners must sign.). This information is a synopsis of the homeowners' property tax exemption. ® disabled homeowners’ exemption initial application dhe initial rev.

It’s calculated at 50 percent of your home’s appraised value, meaning you’re only paying half the usual taxes for your. To receive homestead for the current tax year a homeowner can file an application for homestead exemption for their home and land any time during the prior year up to the deadline. As a courtesy, our office will mail a claim for homeowners' property tax exemption application whenever there is a purchase or transfer of residential property.

You must file with the county or city where your home is located. A homestead exemption application can. Submit all applications and documentation to the property appraiser in the county where the property is located.

Applying for tax exempt status. Various types of homestead exemptions are available,. For local information, contact your county property appraiser.

If you have never received a homeowner exemption on your home, you will need to file an initial application. Tax savings program for homeowners. If you do not provide an estimated income, it will delay the processing of your application.

New york’s senior exemption is also pretty generous. There is an opportunity available in montgomery, alabama for a home health, registered nurse (rn). If you have any issues filing your home exemption online, please contact the real property assessment division via email or phone:.

Call the office or use a hard copy to file an exemption. New property owners will automatically. The general deadline for filing an exemption application is before may 1.

.png)